Fact Check

Fact-Checking Claims Made About Oklahoma’s Lawsuit Against Tyson Foods

Food•5 min read

News

The nation’s largest retailer is poised to become a significant player in the beef industry, owning cattle from slaughter to sale.

Words by John McCracken, Investigate Midwest

This story was originally published on Investigate Midwest.

To Mike Schultz, Kansas ranchers are stuck in velvet handcuffs.

Walmart, the nation’s largest grocery retailer and private employer, recently expanded into the U.S. beef industry with its own processing plant in Olathe, Kansas, a suburb of Kansas City. The opening of the Walmart-owned plant in July marked a turning point for the company and the nation’s cattle industry.

Schultz, a cattle rancher in Brewster, Kansas, — a state that accounts for roughly 4% of the nation’s cattle supply — said for now, local ranchers are likely to have better prices with Walmart bidding against other beef giants.

But Walmart is known for cheap prices and Schultz believes the Arkansas-based retailer will soon look to drive down the price it pays for cattle.

“If you want a race to the bottom to produce cheaper than anybody else, Walmart’s your guy,” he said.

This year, the nation’s beef industry is at a crossroads. Ranchers and agricultural experts warn the nation’s already stunted beef industry could be falling under more corporate control.

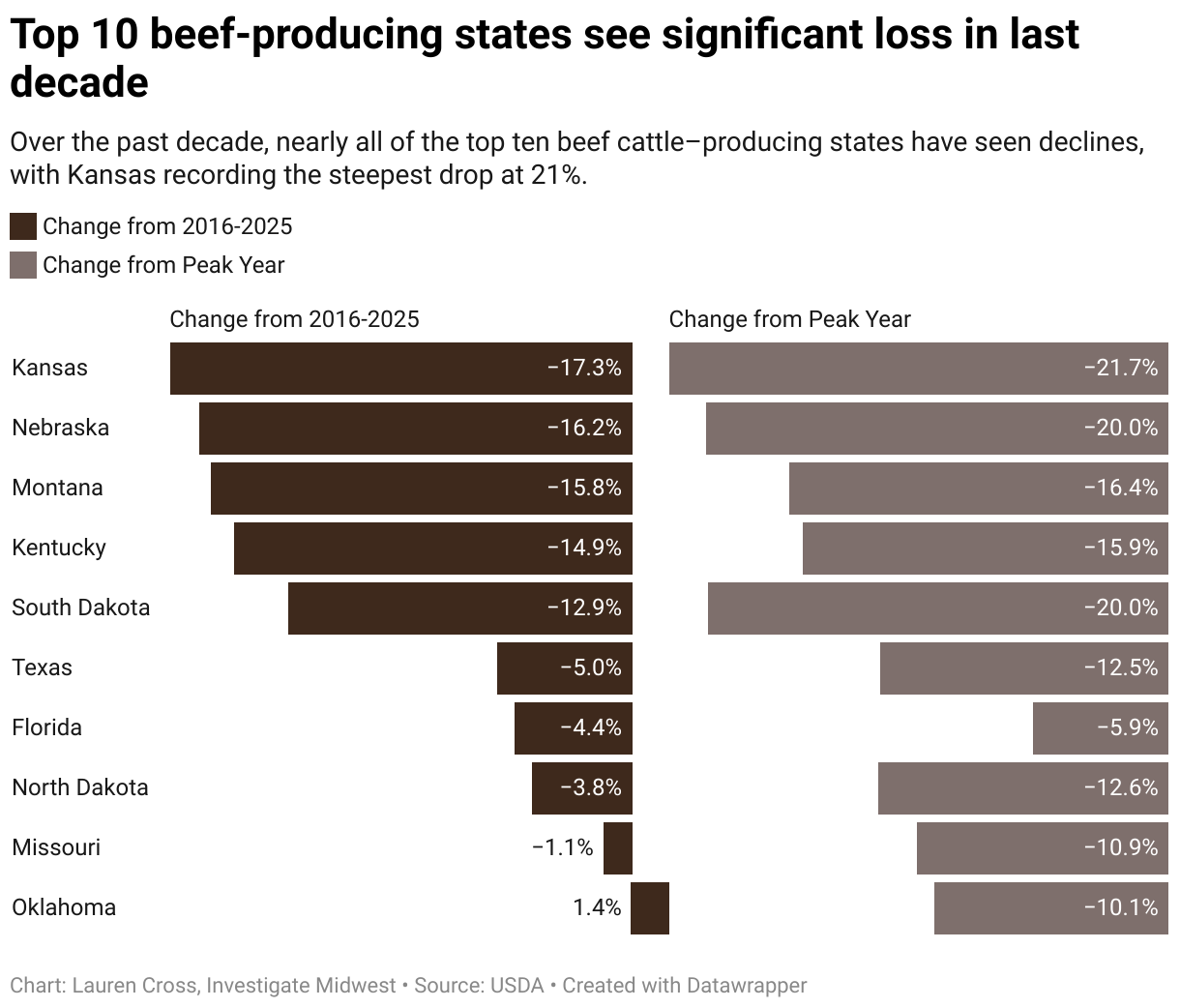

The domestic herd is at a record low as the U.S. imports more beef than ever before. Brazilian meat giant JBS, the world’s largest beef producer, recently became a publicly traded company with access to U.S. capital, and consumers are spending record prices on beef at the grocery store.Walmart is now poised to become a significant player in the beef industry, owning cattle from slaughter to sale. This comes at a time when ranchers have fewer buyers for their cattle and declining inventory.Nine out of 10 states that make up the majority of the nation’s beef supply have seen a decline in the past decade, according to a review of USDA data.

Kansas has seen the largest loss, from 1.4 million in 2016 to 1.2 million in 2025, a 21% decline.

Mike Callicrate, owner of Ranch Direct Foods in Colorado Springs and an advocate for family farms, believes Walmart’s entry into the beef industry at the same time JBS went public on the New York Stock Exchange is the “last domino” to fall for independent ranchers.

Beef is a heavily consolidated industry, with four companies controlling nearly all of the nation’s supply. The federal government attempted to rein in the power of the consolidated meat industry in recent years, but under the Trump administration, guidelines for preventing and investigating antitrust violations in agriculture were scrapped.

“I think our industry is in real trouble until we start enforcing antitrust laws and breaking up concentrated power,” Callicrate said. “You cannot let Walmart control the supply chain.”

Walmart’s Kansas beef plant is not the first time the company has dipped its toe into owning parts of the nation’s beef supply chain. It is, however, the first time they’ve had full control.

In 2020, it opened a Thomasville, Georgia, beef processing facility. Owned by a separate food company, the facility’s employees process beef to be case-ready — taking large cuts and slicing them into smaller portions before packaging them for the meat case at their grocery stores.

An independent ranching company supplies the Georgia plant with meat from multiple herds across the region.

Walmart fully owns and operates its new Kansas plant and also holds a minority stake in Sustainable Beef, the Nebraska-based cattle company that sources cattle within a 250-mile radius, including Kansas.

The Kansas plant will provide beef for Walmart stores in Missouri, Arkansas, Iowa, Nebraska, Colorado, Montana, Wyoming, North Dakota, Oklahoma, Minnesota and Wisconsin, according to the company.

Walmart’s foray into the beef industry is not adding new cattle to the market, but rather competing for cattle in an overwhelmingly consolidated market.

JBS, Tyson Foods, Cargill and Marfrig control roughly 85% of the U.S. beef industry, according to industry estimates.

Walmart’s buying and processing of its own beef will initially compete directly with these companies. It could also reduce the amount of meat it buys from Tyson and Cargill, according to the company’s statements.

Walmart accounts for such a large portion of Tyson’s sales – almost 20% – that Tyson has said in SEC filings that if this were to be disrupted, it would “have a material impact” on their operations. Tyson did not respond to a request for comment on Walmart’s expansion into the beef industry.

Walmart first announced its plan to enter the beef industry in 2019, stating it wanted to create an end-to-end supply chain for Angus beef, which led to its Georgia and Kansas plants.

“It’s important to build more resiliency and capacity in the industry,” a Walmart spokesperson said in an email statement to Investigate Midwest. “Opening a case-ready facility fully owned and operated by Walmart allows us greater control over the products entering our stores so we can continue to bring the highest quality offerings possible.”

Walmart said it has no plans to open another beef processing plant in the future, according to the statement. The company did not answer specific questions about its role in the concentrated meat industry and who it sees as competitors in this space.

Schultz, the Kansas rancher, said it’s an appealing prospect for ranchers to sign on with Walmart, as it’s likely offering better prices than competitors.

“Ranchers are going to make some money for a little bit, but once they’ve got their hooks in you, you’re done,” he said.

This isn’t the first time Walmart has captured a section of its food supply. Walmart opened a Fort Wayne, Indiana, milk-processing plant in 2018 to cut out major milk processors. Grocery stores Kroger and Albertsons also opened milk-bottling plants in 2017.

Greg Foran, former Walmart CEO of American stores, said the company decided to enter meat and dairy spaces because of the consolidated nature of those industries, speaking to CNN in 2019.“What drives a decision like that is if we start to see a consolidation in supply,” Foran said.Foran noted that Walmart’s prices for milk had risen and the company aimed for “leverage” with its distributors when finalizing contracts.Austin Frerick, an agricultural antitrust expert and author of the book “Barons: Money, Power, and the Corruption of America’s Food Industry,” said Walmart is known for its power in the food supply chain because of the volume of products it purchases, often dictating the prices of many food items.

“The most powerful person in the food system is Walmart and entering the beef industry only adds to their power,” Frerick said.

While Walmart expands into the U.S. beef industry, foreign companies are filling in gaps left by the nation’s declining cattle herd.

The U.S. increased its beef and veal imports by 38% from 2015 to 2024.

Spurred by rising costs and prolonged droughts in recent years, the U.S. cattle herd sits at just under 28 million, the lowest since 1962.

Brazil’s impact on the nation’s agriculture sector has caught the attention of the United States Trade Representative, USTR, the nation’s negotiating office for global trade.

The USTR held an investigative hearing on Sept. 3 into Brazil’s trade practices and any related harms to the U.S. economy. Representatives of the U.S. beef industry spoke at the hearing, saying Brazil has not been transparent in its sourcing and animal health practices in the beef industry.

“The United States holds all trading partners to the highest science-based standards, and Brazil should not be the exception,” said Kent Bacus, executive director of government affairs for the nation’s beef industry trade group, National Cattlemen’s Beef Association, at the hearing.

Since the beginning of this year, Brazil, a major cattle-producing country, has imported a record number of beef into the U.S., despite ongoing tariffs and trade disputes.

JBS, the world’s largest meat company, headquartered in São Paulo, Brazil, benefits from these imports and a declining cattle herd in the U.S., and will now have access to the country’s domestic capital markets after becoming a publicly traded company on the U.S. Stock Exchange in July.

According to documents filed with the U.S. Securities and Exchange Commission, JBS’s North American beef segment is the largest revenue producer for the company, coming in at over $13 billion at the end of June.

The company’s SEC registration documents note the beef industry is volatile, and JBS avoids volatility by not owning cattle, unlike its poultry and pork segments.

The nation’s beef industry has skirted the problems its protein counterparts, chicken and pork, have faced in recent decades, leaving American ranchers one of the few remaining independent animal farmers.The majority of the nation’s chicken is produced under contract, meaning the farmers are essentially independent workers who raise animals for a corporation, while 74% of hogs raised in the country as of 2020 were raised under contract. Contract farming has been linked to a decline in competition and an increase in economic exploitation.Currently, the nation’s beef herd is not under contract, but beef industry experts worry Walmart’s expansion is a step in the wrong direction.

“What Walmart is doing will lessen competition in the beef industry,” said Bill Bullard, CEO of R-CALF, a cattle producer-only trade association. “It’ll mean less competition. It’ll mean fewer producers and it’ll mean a more concentrated and centralized food production system that is contrary to the national security of this country.”

Bullard said continued concentration and capture of the beef industry will make ranchers exit the industry or go the way of poultry or pork.

“The writing is on the wall,” he said. “We will continue to see more ranchers exit the industry and we will continue to see fewer cows in the U.S beef cow herd. Walmart is simply just another step in the road to fully integrated, industrialized food production.”

This article first appeared on Investigate Midwest and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.