Explainer

What Is Ultra-Processed Food and Why Is It Unhealthy?

Diet•7 min read

Reported

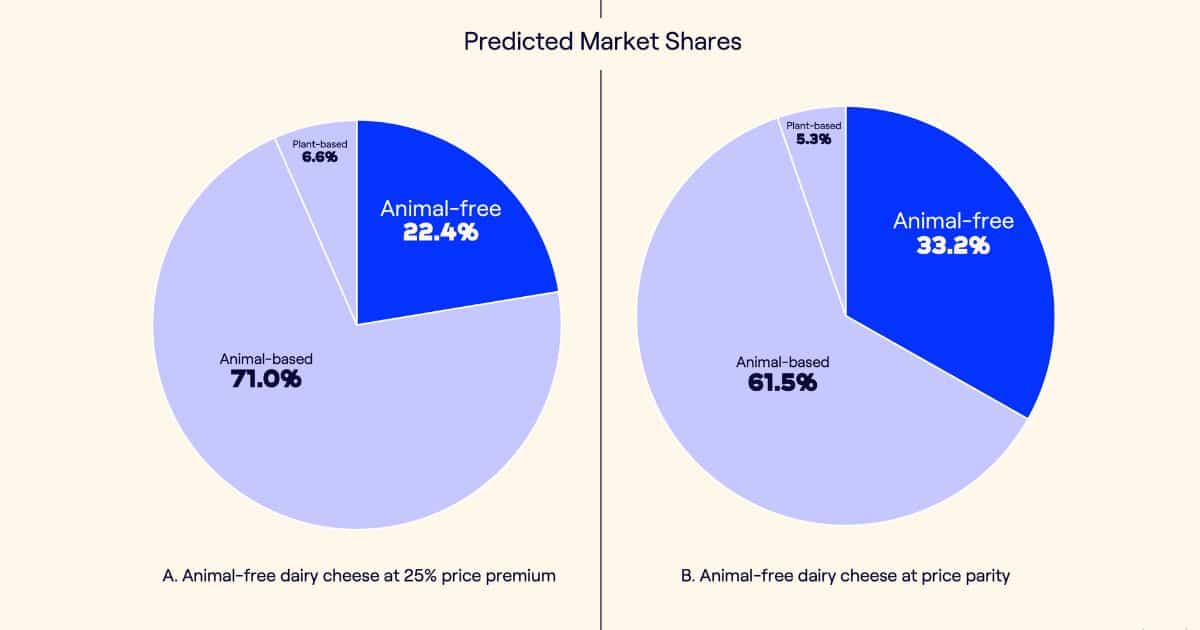

Milk made with precision fermentation could take up to 33 percent of the dairy industry’s market share.

Words by Björn Ólafsson

Plant-based milk has been in the mainstream for several years now — nowadays it’s hard to find a cafe without at least one dairy alternative. But, slowly and surely, a new animal-free product is breaking out, one that isn’t made from plants at all but uses a technology similar to lab-grown meat: precision-fermented dairy. A new report, conducted by precision-fermentation company Formo and the University of Saskatchewan, shows that animal-free dairy has the potential to nab up to 33 percent of dairy’s current market share.

Animal-free dairy is made with all the same cells as animal-based dairy only created in a bioreactor, not a factory farm. In the U.S., companies like Perfect Day have had cultivated ice cream on the market since 2019. Formo, a leading company about to debut a line of animal-free cheeses in Europe, say their products have massive potential. The cheese “will win hearts and minds rapidly,” says Oscar Zollman Thomas, a researcher with Formo.

Lab-grown dairy is made in a process that’s similar to cultivated meat, although faster and more efficient. Companies will toss yeast, simple sugars and cow’s milk gene sequences into a bioreactor and create whey and casein, two of mammalian milk’s most important proteins. Fat and flavoring may then be added to create the perfect taste and texture.

The result is a product that looks, tastes, smells and feels essentially indistinguishable from cow’s milk. Formo says it has enacted rigorous blind taste testing and had conversations with European chefs to make sure the product will hold up when compared to animal cheese. Now, the new study argues this novel dairy product has the potential for a massive market disruption.

Researchers asked over a thousand UK residents about their hypothetical choices in a cheese aisle of a supermarket: three types of mozzarella, one plant-based option and one precision fermented option. The choices were also presented with different price points, intended to replicate how the product would initially debut with slightly higher prices that would come down over time.

The result was large support for animal-free cheese — nearly 65 percent of study participants said they would be willing to try the product. And only 21 percent of them are people who don’t normally eat cheese, indicating this push is driven by flexitarians and other meat-eaters.

Thomas feels the biggest driver is likely animal welfare. Consumers often have contradictory relationships with farmed animals – for example, nearly 50 percent of people in the U.S. would support a ban on factory farming but 99 percent of meat-eaters consume products from factory farms.

People are looking to replace cruel products with equal alternatives, says Thomas, “this was the most recognised advantage of precision fermentation.”

Another reason is the product itself. Cheese is a processed food, and consumers know it. Meat is often held out as a “natural” food (despite the fact that meat too is often processed), which is why some consumers cast off cultivated meat as ultra-processed and unhealthy. Formo doesn’t have to worry about that.

After seeing the support for precision products, the researchers then used statistical analysis to predict how much of the market share a company like Formo could potentially nab. If animal-free dairy is priced 25 percent above traditional dairy, it can take around 22 percent of the cheese market — but at price parity, it will reach a third.

Milk consumption has been on a decades-long decline in the United States — a drop of nearly 50 percent in the last fifty years, across all age groups, in nearly every way. Part of the decline can be attributed to the rise of plant-based milk: more and more consumers are adding soy milk to their lattes or having an almond milk-based smoothie.

The milk industry is experiencing other setbacks. Surplus milk is being dumped down gutters across the Midwest and thousands of dairy farms are going under. This has led the dairy industry to jumpstart old ad campaigns in an effort to recapture floundering sales, sometimes leading to controversy.

But that doesn’t mean dairy is dead, far from it. While fluid milk is down, cheese and yogurt are going up. Way up. Yogurt has been steadily rising for the last decade and cheese and spreadable dairy products like cream cheese have seen their own bumps as well. And dairy is growing in many places around the world, including lower and middle income countries.

Plant-based alternatives to these products haven’t gripped the mainstream in the way that plant-based milk sales have exploded. This is also why Formo’s executives are hopeful animal-free cheese can do what nut-based cheese couldn’t.

However, cultivated dairy, like all food innovations, still has an uphill battle in marking their way into the mainstream.

The EU, where Formo intends to launch first, doesn’t allow for precision-fermented or plant-based products to use words like “dairy” or “milk” in their packaging thanks to lobbying from the dairy industry. Formo is hopeful that as long as consumers understand the product, the labels won’t be an issue.

The study had this distinctive feature that could be key: a written explanation of what precision fermentation actually is, allowing potential consumers to make an informed decision. This is a far cry from what happens in grocery store aisles, where most people choose based on labeling alone even though misinformation about alternative proteins runs rampant.

Research shows most potential consumers have multiple questions about how animal-free dairy is made and its health effects — the two biggest causes of concern. Companies like Formo will only be able to succeed if they are able to be transparent with consumers as they market the health, taste and safety of their products.

“When consumers understand what precision fermentation is and what if offers, they’re ready to jump on it,” argues CEO and founder Raffael Wohlgensinger. The critical question then is when will companies reach this threshold of consumer trust?

In the U.S., several companies are currently selling lab-grown milk or other dairy products: Perfect Day, Bel Brands, Cowabunga, Betterland Milk and Strive Nutrition among them. There are 28 dairy fermentation companies across the world, according to alternative protein thinktank Good Food Institute, many of which are in research and development phases.

Precision fermentation does possess a number of inherent advantages: it’s a cheaper process than meat cultivation, so companies like Formo are likely to hit price parity faster than cell-cultivated products. According to internal estimates, Wohlgensinger says this could happen as early as 2025.

And, since precision fermentation has been around since the 80s, it can get to market and clear regulatory hurdles a bit faster than completely novel techniques like cell-cultivated meat.

And, since precision fermentation has been around since the 80s, it can get to market and clear regulatory hurdles a bit faster than completely novel techniques like cell-cultivated meat. With these advantages, Formo is “all set” to launch in Europe later this year, eyeing its next steps to win over consumers.